High-level Genomic Sequencing Expenditure

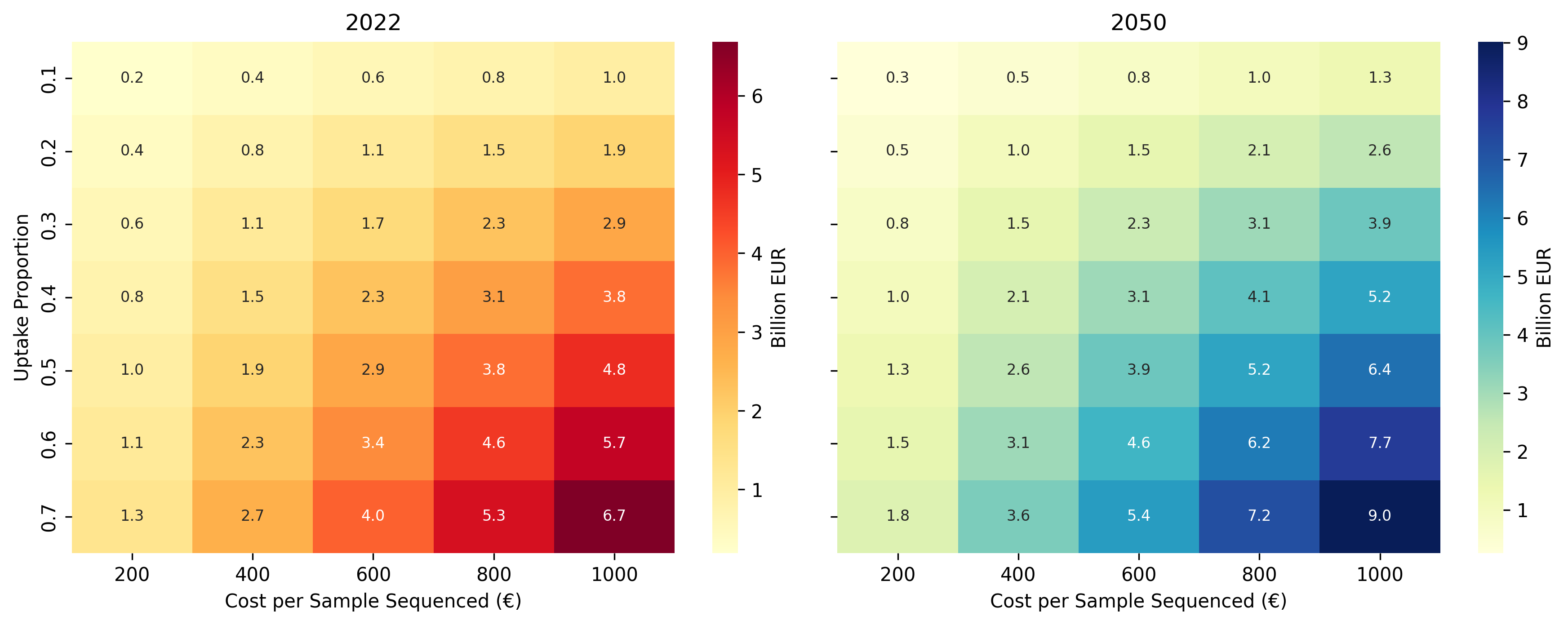

Before delving into specific countries and cancer subtypes, this section presents a top-down bounding analysis of potential genomic sequencing expenditure in oncology, anchored to current (2022) and projected (2050) cancer incidence. These estimates focus on sequencing run costs only, rather than the full cost of cancer diagnostics or treatment pathways. The objective is not precise forecasting, but to illustrate how cancer incidence, testing uptake, and per-test cost together shape the overall sequencing market.

Europe and North America are aggregated as regions where genomic testing has already achieved substantial clinical adoption, allowing projected incidence growth to be translated into an initial, order-of-magnitude estimate of sequencing demand.

The model assumes one sequencing test per newly diagnosed cancer case and explores a range of uptake scenarios, defined as the proportion of new cases undergoing genomic testing. Per-sample sequencing costs are varied between €200 and €1000, reflecting typical price ranges for targeted oncology panels, which remain the dominant clinical approach for identifying actionable mutations.